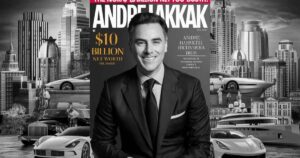

In the dynamic world of alternative lending and financial services, few names command as much respect as Andre Hakkak. As the CEO and co-founder of White Oak Global Advisors, Hakkak has established himself as a pioneering force in private credit markets. This comprehensive analysis delves into the financial success and wealth accumulation of one of finance’s most innovative leaders. Andre Hakkak Net Worth: In-Depth Look.

Early Life and Education

Andre Hakkak’s journey to financial success began with a strong educational foundation. Having graduated with honors in economics, he developed a keen understanding of market dynamics early in his academic career. His educational path was marked by:

- Bachelor’s degree in Economics

- Advanced studies in Financial Markets

- Specialized training in Investment Management

- Early exposure to alternative lending strategies

What set Hakkak apart was his unique ability to identify market inefficiencies and opportunities others overlooked. This analytical mindset, combined with his academic excellence, laid the groundwork for his future success.

Beginning of Career

The early stages of Andre Hakkak’s career were characterized by strategic moves and valuable experience gathering. His initial roles in traditional banking provided crucial insights into lending practices and market dynamics. Notable early career highlights include:

- Investment Banking positions at leading firms

- Risk management roles

- Portfolio management experience

- Development of proprietary lending strategies

“Understanding market gaps and creating solutions for underserved segments became my primary focus early in my career.” – Andre Hakkak

White Oak Global Advisors was Founded

In 2007, Andre Hakkak co-founded White Oak Global Advisors, marking a pivotal moment in his career. The firm’s establishment came at a crucial time, just before the global financial crisis, which ultimately proved advantageous for its business model. Andre Hakkak Net Worth: In-Depth Look.

Key Milestones:

| Year | Achievement | Established an alternative lending platform |

|---|---|---|

| 2007 | Company Founded | Established alternative lending platform |

| 2008-2009 | Financial Crisis Navigation | Demonstrated resilience of business model |

| 2010-2015 | Rapid Expansion | Significant portfolio growth |

| 2016-Present | Global Market Presence | International operational expansion |

Source of Income

Andre Hakkak’s wealth stems from multiple revenue streams, primarily through his leadership and ownership stake in White Oak Global Advisors. His income sources include:

- Primary Revenue Channels:

- Management fees from assets under management

- Performance-based incentives

- Investment returns

- Advisory services

- Board positions

- Business Ventures:

- Strategic partnerships

- Private equity investments

- Real estate holdings

- Technology investments

Salary and Bonuses

While specific compensation figures are private, industry analysis suggests Andre Hakkak’s annual earnings are substantial. Based on comparable industry positions:

- Base Salary: Estimated in the high seven figures

- Performance Bonuses: Potentially exceeding base salary in strong years

- Equity Appreciation: Significant portion of overall wealth

- Additional Benefits: Executive perks and investment opportunities

Investments

Andre Hakkak’s investment philosophy centers on value creation through alternative lending and strategic asset allocation. His portfolio includes:

Investment Categories:

- Private credit instruments

- Real estate holdings

- Technology startups

- Traditional market investments

- Infrastructure projects

Philanthropy

Beyond his business success, Andre Hakkak has demonstrated a strong commitment to philanthropic causes. His charitable work focuses on:

- Education Initiatives:

- Scholarship programs

- Financial literacy projects

- Academic research funding

- Community Development:

- Local business support programs

- Infrastructure development

- Social enterprise funding

Steps to Estimate Andre Hakkak’s Net Worth

Calculating Andre Hakkak’s net worth involves analyzing multiple factors:

- Assets Under Consideration:

- White Oak Global Advisors ownership stake

- Personal investment portfolio

- Real estate holdings

- Private investments

- Valuation Metrics:

- Company valuation multiples

- Market comparables

- Asset appreciation

- Revenue streams

Possible Advantages and Disadvantages for the Finance Industry

Advantages:

- Innovation in lending practices

- Market efficiency improvements

- Enhanced access to capital

- Risk management advancement

Disadvantages:

- Market concentration concerns

- Competitive pressures

- Regulatory scrutiny

- Systemic risk considerations

Future Plans

Andre Hakkak’s vision for the future includes:

- Business Expansion:

- Geographic market expansion

- Product line diversification

- Technology integration

- Strategic acquisitions

- Industry Development:

- Market innovation

- Sustainable finance initiatives

- Digital transformation

- Industry standardization efforts

FAQ

Q1: Who is Andre Hakkak?

Andre Hakkak is the CEO and co-founder of White Oak Global Advisors, a leading alternative asset management firm specializing in originating and providing financing solutions to facilitate the growth, refinancing, and recapitalization of small and medium enterprises.

Q2: What steps did Hakkak take to amass his fortune?

His wealth accumulation strategy involved:

- Building a successful alternative lending platform

- Strategic market timing

- Innovative business model development

- Consistent value creation for stakeholders

Q3: In your opinion, what is Andre Hakkak’s net worth?

While exact figures are private, industry estimates suggest his net worth is substantial, derived primarily from his ownership stake in White Oak Global Advisors and various investment holdings.

Q4: Does Andre Hakkak commit to charitable work?

Yes, he maintains an active philanthropic presence through educational initiatives, community development programs, and social enterprise support.

Q5: What is White Oak Global Advisors?

White Oak Global Advisors is a leading alternative asset management firm providing financing solutions to small and medium enterprises, with billions in assets under management.

Conclusion:

Andre Hakkak’s journey represents a masterclass in building wealth through innovation in financial services. His success story continues to evolve, making him a prominent figure in the alternative lending space. Through strategic vision, market insight, and commitment to value creation, Hakkak has built not just personal wealth but also a lasting impact on the financial industry.